The Indian Rupee Hits Record Low against the US dollar, and babe, this isn’t just a finance headline. It’s a warning sign for every Indian household, because a weak rupee quietly makes your life more expensive — petrol, groceries, EMIs, gadgets, travel… everything gets hit.

Here’s the no-filter breakdown of what this fall actually means for your wallet in 2026.

Why the Indian Rupee Hits Record Low in 2025

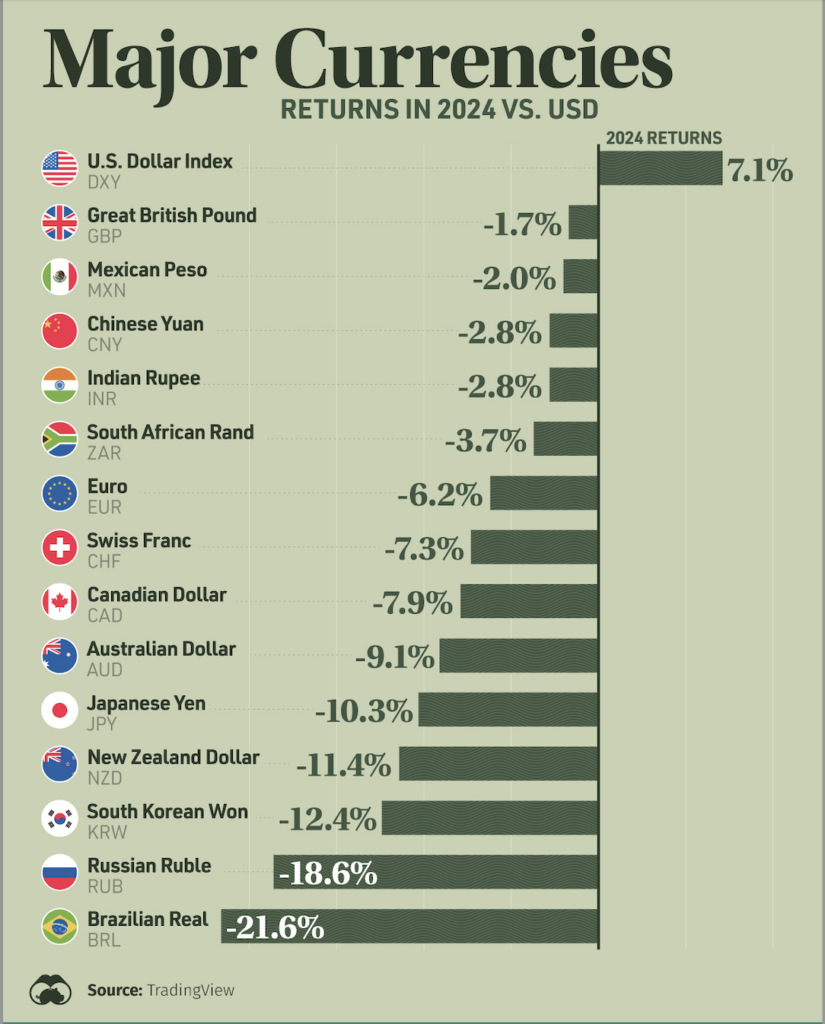

The rupee didn’t crash overnight. The drop happened because of a mix of global pressure and India’s own economic challenges. According to Reuters, the rupee slipped to a fresh all-time low while the RBI stepped in to limit the damage.

The big reasons behind the fall:

1. Heavy demand for USD

India imports oil, electronics, machinery — all paid in dollars.

More demand → INR goes down.

2. Global uncertainty

When the US economy tightens, emerging markets like India take the hit.

3. High trade deficit

We’re buying more from the world than we’re selling.

4. Foreign investors pulling out

FIIs exit → INR weakens → markets shake.

So yes, the Indian Rupee Hits Record Low not because of one bad day, but because the entire system is under pressure.

How the “Indian Rupee Hits Record Low” Affects Your Daily Life

This part hurts — because when the rupee falls, YOU pay the price.

Let’s break it down without sugarcoating anything.

Petrol and Diesel Will Get More Expensive

India buys crude oil in dollars.

A weaker rupee = more expensive oil = higher fuel prices.

This directly increases:

- commute cost

- cab fares

- food delivery charges

- transportation rates

When the Indian Rupee Hits Record Low, petrol becomes the first to attack your wallet.

Imported Gadgets = Major Price Hikes

iPhones, laptops, PlayStation, cameras… all priced in dollars.

So in 2026:

- iPhones become costlier

- premium Androids get more expensive

- Laptops and GPUs shoot up

- Camera lenses jump in price

Your “I’ll buy it during sale” dream?

Dead.

Foreign Travel Will Burn Your Savings

A record-low rupee is the fastest way to kill travel dreams.

Your budget for:

- Dubai

- Thailand

- Europe

- US

…all doubles instantly.

A weak rupee makes everything abroad — food, hotels, shopping — insanely expensive.

Daily Groceries & Essentials Get Costlier

Why?

Because even your “Indian products” depend on:

- imported materials

- imported fuel

- imported machinery

So you’ll see higher prices in:

- packaged food

- milk & veggies

- electronics

- transport

- restaurant bills

- medicines

Inflation becomes part of life.

EMIs & Loans May Rise

When the Indian Rupee Hits Record Low, banks tighten lending.

Expect:

- higher interest rates

- higher home loan EMIs

- costlier car loans

- expensive personal loans

The middle class gets squeezed from every direction.

What RBI Does When the Indian Rupee Hits Record Low

RBI steps in to avoid panic:

- selling dollars

- adjusting liquidity

- stabilizing short-term volatility

But global pressure is stronger than any single intervention.

RBI can slow down the fall — not reverse it overnight.

Will the Indian Rupee Recover After Hitting a Record Low?

Not easily.

Economists expect:

- continued global uncertainty

- slow and unstable recovery

- weaker imports

- stubborn inflation

- volatile markets through 2026

Unless global conditions improve, the rupee will keep struggling.

So yes, prepare for a realistic, not rosy 2026.

The Real Impact of “Indian Rupee Hits Record Low”

A falling rupee hits every Indian — directly or indirectly.

In 2026, expect:

- costlier essentials

- higher fuel prices

- expensive travel

- volatile market

- tighter budgets

Your wallet will feel the pressure unless global markets stabilize soon.

The Indian Rupee Hits Record Low, and the middle class ends up paying the highest price.

FAQs

Why did the Indian Rupee hit a record low?

High import costs, global uncertainty, weak investor sentiment, and dollar demand.

Does the rupee fall affect petrol prices?

Yes. A weaker rupee makes oil imports costlier, pushing petrol and diesel prices up.

Will the rupee recover in 2026?

Not immediately. Global economic pressure will keep INR volatile.

How does a weak rupee impact daily life?

Groceries, fuel, gadgets, travel, loans — everything becomes more expensive.

Is this bad for the middle class?

Yes. Higher inflation + higher EMIs + expensive imports hit the middle class hardest.

1 thought on “Indian Rupee Hits Record Low — What It Means for Your Wallet in 2026”