The Indian middle class is confused in 2025.

Salaries are higher. Promotions look good on LinkedIn. Dual-income households are now normal. And yet, most middle-class families feel financially drained, anxious, and stuck.

Not poor.

Not rich.

Just constantly stressed.

So why Indian middle-class families feel broke in 2025 despite earning more than ever before?

Earning More, Saving Less — The Silent Shift

On paper, income growth looks decent. But real life tells a different story.

Rent, groceries, school fees, fuel, insurance — everything costs more, and it increases quietly. What used to feel manageable five years ago now eats up entire paychecks.

According to coverage from The Economic Times, household savings in India have been under consistent pressure as essential expenses continue to rise faster than income growth.

The result?

You earn more — but nothing stays.

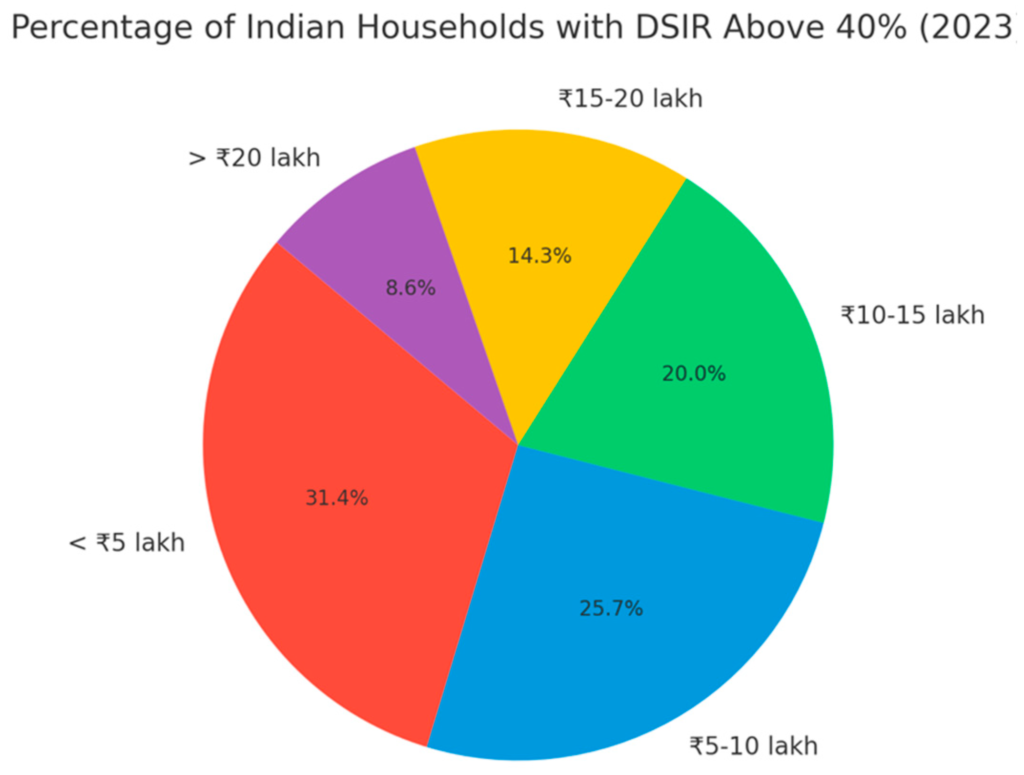

EMIs Have Taken Over Middle-Class Life

The modern Indian middle-class lifestyle is built on EMIs.

- Home loans

- Car loans

- Education loans

- Credit card EMIs

- Even smartphones and appliances

Individually, they seem affordable. Together, they quietly kill cash flow.

As Business Today has repeatedly highlighted, easy credit access has made monthly repayments feel normal — until families realise they’re living paycheck to paycheck.

Savings didn’t disappear overnight.

They were replaced by EMIs.

Lifestyle Inflation Nobody Warned Us About

Here’s the uncomfortable truth.

The middle class didn’t just need more money — it was trained to spend more.

- Better housing societies

- Expensive schools

- Multiple OTT subscriptions

- Frequent online shopping

- “Once-in-a-while” trips that happen every year

None of this feels luxurious anymore. It feels necessary.

And when budgets tighten, entertainment is often the first thing to go — which is exactly why OTT burnout in India is becoming real, with viewers saying web series no longer feel special or worth the time or money.

Lifestyle inflation doesn’t look dangerous.

Until it traps you.

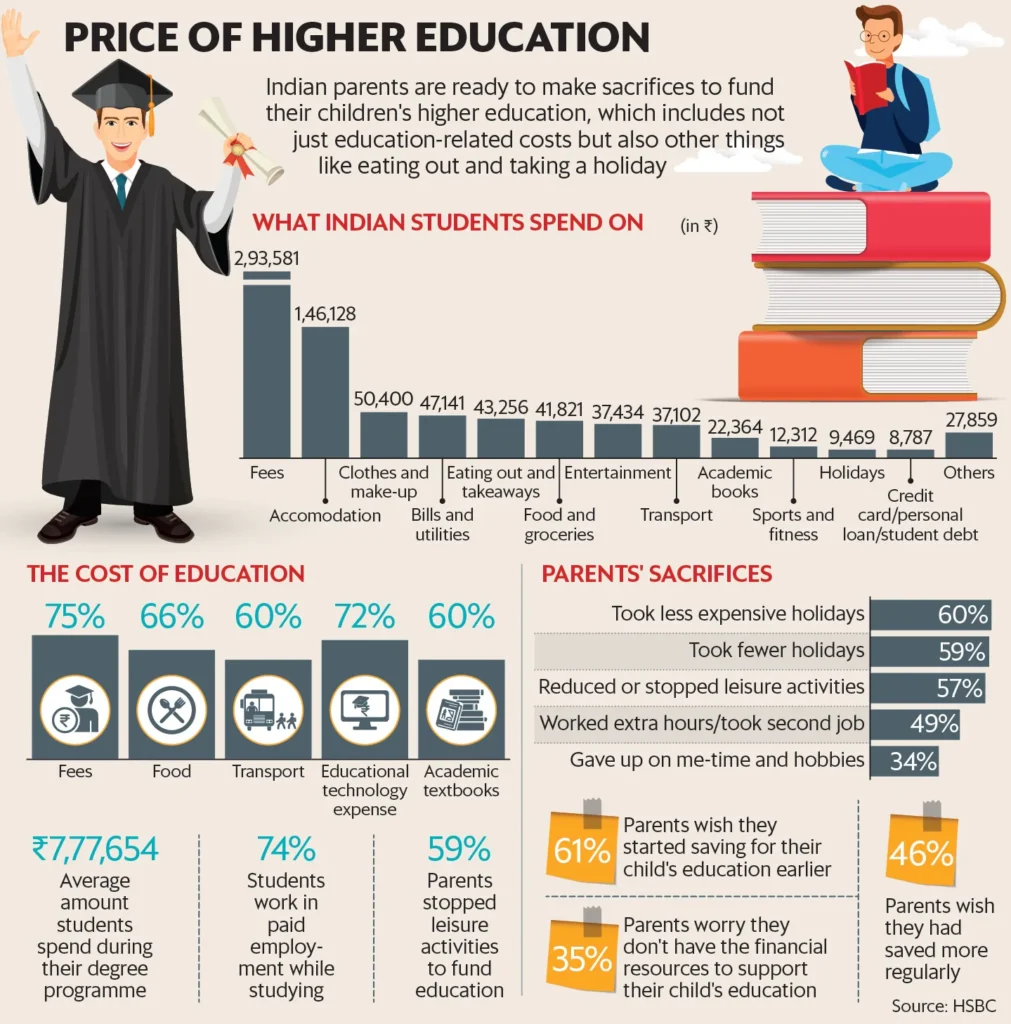

Education Is No Longer Just Education

For middle-class families, education in 2025 is not a phase — it’s a long-term financial burden.

Parents aren’t just paying school fees. They’re paying for:

- Coaching classes

- Competitive exam prep

- Online learning platforms

- “Backup” skill courses

Education spending has turned into financial pressure disguised as responsibility.

Families cut corners elsewhere, but education costs are rarely negotiable.

One Medical Emergency Can Break Everything

This is where fear truly lives.

One hospital visit.

One surgery.

One unexpected diagnosis.

Even with insurance, medical expenses can wipe out years of savings. This constant fear keeps the middle class financially alert but emotionally exhausted.

It’s why families feel broke even when their bank balance says otherwise.

Supporting Two Generations at Once

The Indian middle class in 2025 is squeezed from both sides.

- Supporting aging parents

- Funding children’s futures

- Planning their own retirement

Previous generations didn’t face this pressure simultaneously. Today’s families are expected to hold everyone together — financially and emotionally.

That pressure doesn’t show on Instagram.

But it shows up in stress.

Inflation Hits Harder Than It Looks

When the Indian rupee hits record low, everyday life quietly becomes more expensive — from fuel to imported essentials.

Most middle-class families don’t track macroeconomics. They just feel the impact when monthly budgets stop making sense.

Inflation doesn’t announce itself.

It slowly eats stability.

The Illusion of “Doing Well”

From the outside, everything looks fine:

- Stable jobs

- Decent homes

- Regular shopping

- Occasional vacations

But behind closed doors, many families have:

- Weak emergency funds

- Inconsistent savings

- Fear of job loss

- Anxiety about the future

This isn’t financial failure.

It’s financial fatigue.

Why This Feels Worse in 2025

Because expectations have exploded.

Social media constantly shows:

- Faster success

- Better lifestyles

- “Normal” luxury

The gap between reality and expectation has never been wider. And that psychological pressure makes earning more feel pointless.

The Bottom Line

Indian middle-class families don’t feel broke because they’re irresponsible.

They feel broke because:

- The cost of stability has skyrocketed

- EMIs replaced savings

- Lifestyle inflation became unavoidable

- One emergency can undo everything

Earning more no longer guarantees peace of mind.

And that’s why, in 2025, the Indian middle class keeps asking the same question:

Where is all the money going?

FAQs

Why do Indian middle-class families feel broke despite higher salaries?

Because expenses, EMIs, and lifestyle costs are rising faster than income.

Is this problem limited to urban India?

No. Semi-urban households are increasingly facing the same pressure.

Are EMIs the biggest issue?

They are a major contributor, especially when combined with stagnant savings.

Has inflation made things worse in 2025?

Yes. Inflation and a weaker rupee have increased daily living costs.

Is the Indian middle class actually poorer now?

Not poorer — but far more financially stressed.

1 thought on “Why Indian Middle-Class Families Feel Broke in 2025 Despite Earning More”