For years, the Indian middle class has repeated the same complaint: “We’re struggling to survive.”

Rising prices, shrinking savings, endless EMIs, and a constant feeling of being one emergency away from panic.

That anxiety isn’t imagined. Multiple recent trends showing middle-class financial stress already point to how fragile household finances have become — even among families with stable incomes.

But here’s the uncomfortable truth nobody wants to confront:

Indian middle class financial illiteracy is a bigger problem than low income itself.

Yes, inflation is real. Yes, salaries are lagging.

But the way the middle class manages money in 2025 is quietly making everything worse.

And no one is calling it out honestly.

The Middle Class Isn’t Poor — It’s Financially Unprepared

On paper, most middle-class households aren’t doing terribly. Dual incomes. Predictable salaries. Access to credit.

Yet savings are disappearing and emergency funds barely exist. According to data from the Reserve Bank of India’s household finance surveys, household expenses have risen faster than income growth over the last few years — especially in urban India.

Instead of adjusting spending habits, families upgraded lifestyles.

That’s not poverty.

That’s financial unpreparedness disguised as normal life.

This is where Indian middle class financial illiteracy quietly takes root — not in low income, but in everyday decisions.

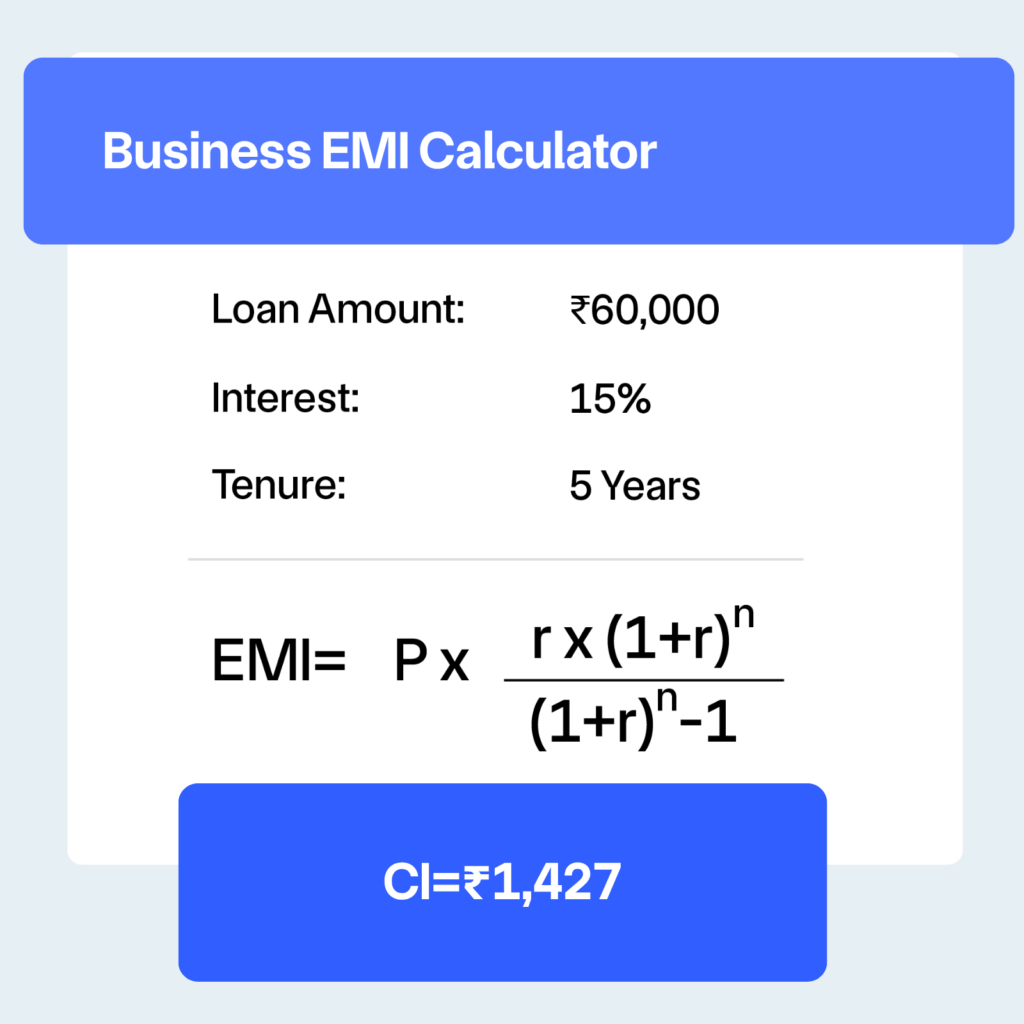

EMI Culture Is Quietly Killing Financial Stability

Easy monthly payments have become emotional comfort.

Car on EMI.

Phone on EMI.

Furniture on EMI.

Even vacations on EMI.

The problem isn’t credit access — it’s blind dependence on it. RBI data shows that unsecured personal loans and credit card usage have surged sharply among salaried households, normalising debt as a lifestyle choice rather than a financial tool.

Most people don’t even know how much interest they’re paying over time.

They just know the monthly number “fits”.

That’s exactly how Indian middle class financial illiteracy works — silently and legally.

Inflation Feels Worse Because the Rupee Is Weaker

Rising prices aren’t happening in isolation. The impact of currency fluctuations on everyday expenses has quietly made imported goods, fuel-linked products, and even education costs more expensive for ordinary households.

A weaker rupee doesn’t just affect markets — it hits grocery bills, travel plans, and long-term savings. When incomes stay flat but costs rise from multiple directions, poor financial planning becomes even more dangerous.

This is where external economic pressure exposes internal financial weakness.

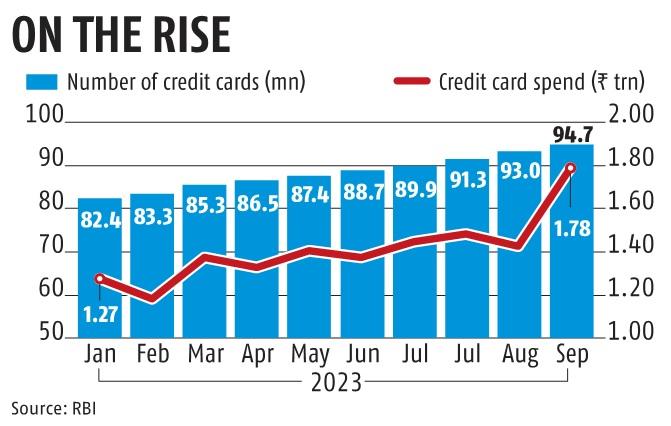

Credit Cards Aren’t Free Money

Credit cards were meant to be tools. They’ve become traps.

Swipe now. Worry later.

Minimum due instead of full payment.

Recent reporting by The Economic Times on rising credit card debt in India highlights growing stress among first-time card users, especially young salaried professionals who were never taught how debt actually works.

This isn’t just irresponsibility.

It’s ignorance — and it’s expensive.

Financial Literacy Is Still Treated Like a “Rich People Thing”

Here’s the most damaging mindset: “Abhi toh manage ho raha hai.”

Planning is postponed. Retirement is delayed. Risk is ignored.

Multiple SEBI-backed financial literacy studies have already warned that financial awareness in India remains low, particularly among middle-class earners who assume stability equals security.

People chase stock tips but don’t understand cash flow.

They talk about investments but ignore discipline.

That gap is the core of Indian middle class financial illiteracy.

The Real Cost of Financial Illiteracy

This isn’t just about money.

It’s about:

- Staying stuck in toxic jobs because of EMIs

- Avoiding risks due to weak savings

- Living with constant anxiety disguised as “normal middle-class life”

Indian middle class financial illiteracy doesn’t just drain wallets — it drains choices.

The Question Nobody Wants to Answer

So here’s the question that makes people uncomfortable:

Are middle-class Indians actually underpaid —

or are they simply bad at managing money?

The answer isn’t flattering.

And that’s exactly why this conversation matters.

Until financial literacy becomes basic survival knowledge, not optional advice,

the middle class will keep feeling broke — no matter how much it earns.

FAQs

What is Indian middle class financial illiteracy?

Indian middle class financial illiteracy refers to poor money management habits—such as over-reliance on EMIs, weak savings, and lack of long-term planning—despite having stable incomes.

Why does the Indian middle class feel broke despite earning more?

Because rising expenses, lifestyle inflation, easy credit, and poor financial planning cancel out income growth, leaving little room for savings or emergencies.

Are EMIs bad for middle-class families in India?

EMIs aren’t bad by default, but excessive dependence on them traps families in fixed monthly obligations and increases financial stress over time.

How do credit cards worsen financial stress for the middle class?

Credit cards encourage spending without immediate consequences. When balances aren’t paid in full, interest quickly builds and erodes savings.

Is financial illiteracy a bigger problem than low income in India?

In many cases, yes. Poor financial decisions amplify the impact of inflation and stagnant wages, making even decent salaries feel insufficient.

How can the Indian middle class improve financial literacy?

By tracking expenses, limiting unnecessary debt, understanding interest costs, and prioritising emergency and retirement savings early.

Will financial literacy alone solve middle-class money problems?

No, but it significantly reduces stress and risk. While systemic issues exist, better financial habits give families more control and flexibility.

1 thought on “Indian Middle Class Financial Illiteracy Is the Real Crisis No One Wants to Admit”